We understand the nuances of the credit market, delivering purpose-built products and solutions tailored to the needs of market participants.

We are a fast-growing technology company developing tools that enhance traditional voice-based trading methods — where relationships are a must — while advancing the credit market through innovation. Trumid delivers a complete electronic bond trading experience through a single application.

Trumid internal data as of full year 2025. YoY represents 2025 vs. 2024.

Total traded volume in 2025

YoY trading volume growth

Onboarded global institutions

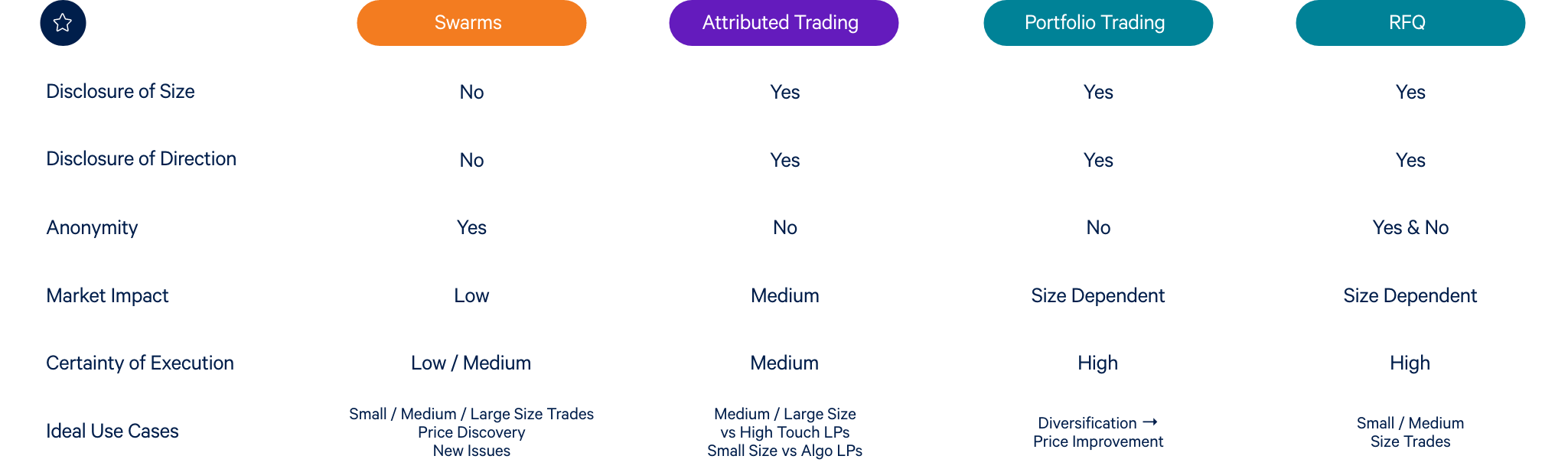

Choose from four distinct and established protocols.

Trumid’s original trading protocol, all-to-all and digitally targeting round-lot trading in credit. Swarms concentrates liquidity in a specific security or list of securities, bringing participants together at a defined time to trade anonymously and electronically.

An in-comp and dealer-to-client protocol to solicit multiple quotes for baskets of bonds and receive quotes within a specified timeframe. Includes Trumid PT Pricer™ — used by clients daily to assess transaction costs pre-trade and benchmark dealer quotes in live sessions.

A bilateral dealer-to-client protocol, enabling dealers to electronically distribute axes and inventory to curated client lists, engage buy-side participants, and execute trades. AT also includes Trumid’s digital voice processing workflow.

An in-comp protocol for trading single bonds and lists, where each security executes with the best-priced responding counterparty. Trumid RFQ supports disclosed, fully anonymous, and partially anonymous workflows — including grey RFQs — and features Trumid AutoPilot™ for RFQ, processing mixed lists up to 500 line items.

Swiftly move between Trumid trading protocols to match your trading goals. Choose based on your preferences for disclosure, market impact, and certainty of execution.

Boost your operational efficiency and drive cost savings platform-wide with our automated corporate bond spotting and hedging technology.

Our platform automatically resolves interest rate risk imbalances, across all Trumid trading protocols, executing U.S. Treasuries directly with top liquidity providers.

Rely on the experts behind our technology for responsive support and tailored solutions, with continuous workflow enhancements designed to optimize your platform experience.