The Art and Science of Trading

The Trumid Ecosystem

Trumid delivers a full ecosystem of protocols and trading solutions within one easy-to-use platform: a seamless and efficient way to trade all protocols and access liquidity from a growing and diverse network of buy-side and sell-side institutions. Built using leading-edge technology and product design, Trumid optimizes the credit trading experience by integrating into your specific workflows.

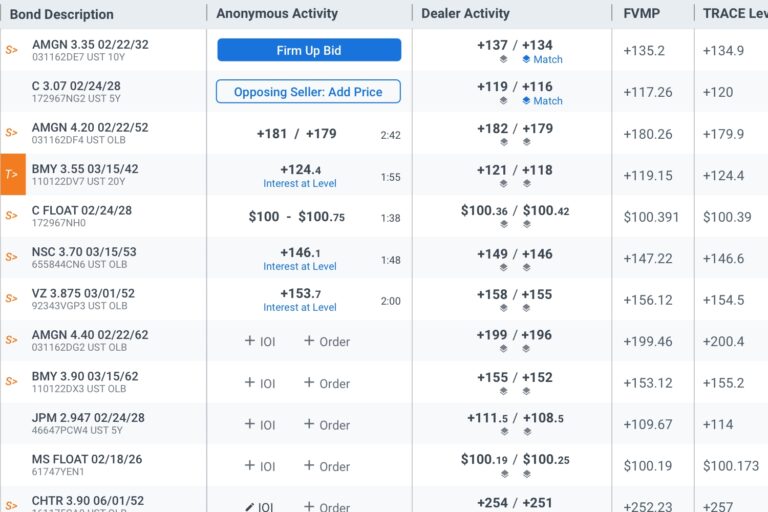

An Optimized Trading Experience, with Protocol Flexibility, Integrated Real-Time Data, and Analytics Tools

Personalized Experience

Select tags based on your trading interest and create watchlists that are personalized to you. Receive smart notifications and trade suggestions on the bonds you care about, alerting you of live markets and liquidity.

Data and Analytics

Inform and optimize trading decisions with access to real-time market data and analytics for price discovery, intelligent execution, and TCA.

Protocol Flexibility

Trade the way you want – choose the protocol that best suits your goals. All Trumid protocols enable best execution and include robust automated spotting functionality.

Liquidity and Technology

Technology is a powerful tool for unlocking liquidity. Interact with high-touch and algorithmic liquidity providers to gain access to efficient, aggregated liquidity that you can’t find elsewhere.

Trade on Trumid

Access a full ecosystem of protocols and trading solutions within one easy-to-use platform.

Market Data

Platform integrated market data and analytics enable you to make informed trading decisions.